Dive In

It's Time To Make A Pivot

Decade over Decade there has always been a particular investment category that took precedence and lead the winners to the top. Knowing when to pivot makes all the difference.

There Hasn't Been a Better Time than Now

So What is our Phase 1?

Design, Build & Manage a large scale Mining Farm.

Despite the future price speculation, we base our strategies on status quo markets and prepare for the volatility. Fact remains, China accounted for 75% of the worlds mining operations and that has now been up for grabs as of Q2 2021.

About US

Get to Know Us & What We Do Then Consider Your Investment Oppurtunities

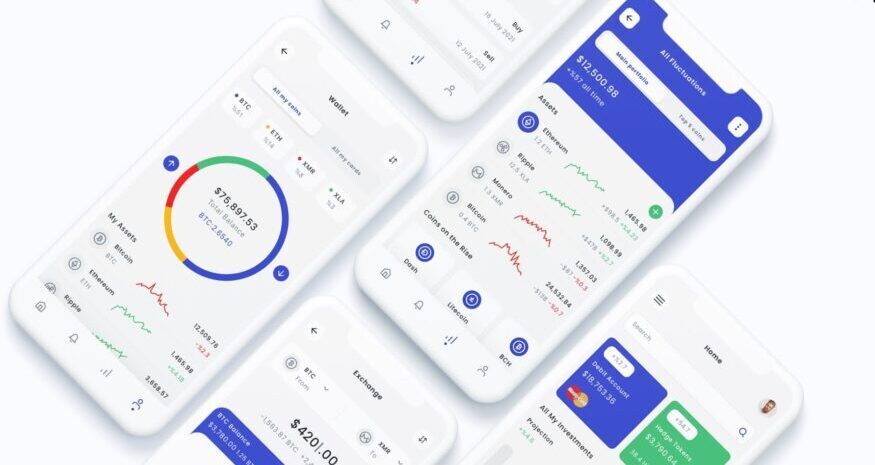

Kal Kesef plans to be a complete service Investment Fund in all things Cryptocurrency. As we roll our individual phases of our plans, we empower you, the investor to decide what areas of the market you find safe for you. From Mining, to Tech Investment, and Straight Crypto investing, we do it for you, but at your comfort level and risk tolerance.

What We've Invested In?

Markets

Top Cryptocurrencies by Market Cap

Market Cap is the total value of all the available cryptocurrency assets that have been mined. In cryptocurrency, market capitalization is calculated by multiplying the total outstanding number of coins that have been mined by the price or value of a single coin at the stated time of that market cap.

Bitcoin (BTC)

Ethereum (ETH)

Tether (USDT)

Cardano (ADA)

USDC (USDC)

| # | Coin | Price | Marketcap | Volume (24h) | Supply | Change | Last 24h |

|---|

Why Investors Choose Kal Kesef

Same Reason you chose Charles Schwab or E-Trade for your Stock Portfolios. You have a Day Job. Run your business, Attend to your Job, Let us do your Crypto Investing. From Many Angles...

GET IN TOUCH

- 140 58th Street, 3F, Brooklyn NY 11220

- +19174977271

- contact@kalkesef.com

- www.kalkesef.com

FAQ

Frequently Asked Questions

As of this writing, the global crypto market cap all-time high is $813.9 billion ($813,871,000,000 USD). The market reached this level on January 7, 2018.

Market capitalization is one of the most popular metrics in finance. It was first introduced in the stock market and has been adapted to the crypto world where it is used to value cryptocurrencies.

Crypto market cap has its supporters and its critics. Supporters view market cap as a simple, albeit incomplete way to rank cryptoasset projects. Critics insist that market cap is not a measure of value but a crude expression of the price investors are willing to pay. Both sides make valid points.

Crypto market cap is calculated by multiplying the circulating supply of a coin by its current price. For example, if a digital currency has 1,000 tokens in circulation, and each token trades at $100, the market capitalization of the project is $100,000.

As with stocks, cryptocurrencies are classified in terms of market cap. Large-cap cryptocurrencies have market caps in excess of $10 billion, mid-cap cryptocurrencies range between $1 billion and $10 billion, and small-cap cryptocurrencies are worth less than $1 billion. In the world of stocks, the higher the market cap, the safer the investment. In the world of cryptocurrencies, a high market cap is less meaningful.

Although market cap is, at best, an incomplete indicator of cryptoasset quality (more on that here), in some cases, it can be a useful starting point for analyzing an investment opportunity.

Market cap reveals a bit about a coin’s characteristics. For example, high market cap could indicate that a cryptocurrency is resistant to volatility. Low market cap indicates the opposite, that major news events or whale activity can significantly impact price. However, crypto market cap can only take you so far. To get a strong read on volatility, you’d have to combine market cap with other metrics like market depth or transaction volume.

Traditionally, stocks are analyzed with metrics such as price-to-earnings (P/E) and earnings-per-share (EPS). Crypto projects don’t publish financial statements, but there is still a need for comparison. Over time, the simplicity of market cap has made it the most popular way to compare cryptoassets. For this reason alone, crypto market cap matters. It’s important because crypto investors, exchanges, aggregators, and project owners think it’s important.

Bitcoin BTC is the world’s leading cryptocurrency by market cap. In terms of market cap, Bitcoin has reached heights of over $300 billion. Most of the time, Bitcoin’s market cap accounts for 30% to 60% of the entire cryptocurrency market cap. To find Bitcoin's market cap, locate the value in the "market cap" column associated with the Bitcoin record in the table above.

As with other cryptoassets, Bitcoin’s market cap is determined by multiplying its circulating supply by its current price. It is worth noting that, due to the finite supply of Bitcoin, at some point, circulating supply and total supply will be equal. At that time, Bitcoin’s market cap will have only one dynamic determinant, the price.

Some investors view low market cap as synonymous with high profit potential. Similar to penny stocks (stocks priced below \$1), low-cap cryptocurrencies are often considered to be undervalued. That is why many market participants favor cryptocurrencies with low market caps. They believe these currencies have more room for price appreciation. Others view low market cap cryptocurrencies as ground-floor opportunities.

Whatever the reasoning, low market cap cryptocurrencies are popular investments. Here’s how to find low market cap cryptocurrencies on the Nomics platform:

- Navigate to Nomics.com.

- Sort cryptocurrencies by market cap.

- Move beyond page 1 to explore low market cap cryptocurrencies